15 Apr Retirement of Treasury Stock Redemptions, Calls, & Purchases

Retired shares Sometimes when a company buys back shares of its own stock, it doesn’t have the desire to hang on to them. In this case, the company can choose to cancel, or retire the shares according to SEC regulations. Once shares are retired, they cannot be reissued, and no longer have any financial value nor do they represent any ownership in the company. On other occasions, the board may decide that shares of treasury stock should be formally retired and thus removed from the issued category.

- The articles and research support materials available on this site are educational and are not intended to be investment or tax advice.

- These materials were downloaded from PwC’s Viewpoint (viewpoint.pwc.com) under license.

- Upgrading to a paid membership gives you access to our extensive collection of plug-and-play Templates designed to power your performance—as well as CFI’s full course catalog and accredited Certification Programs.

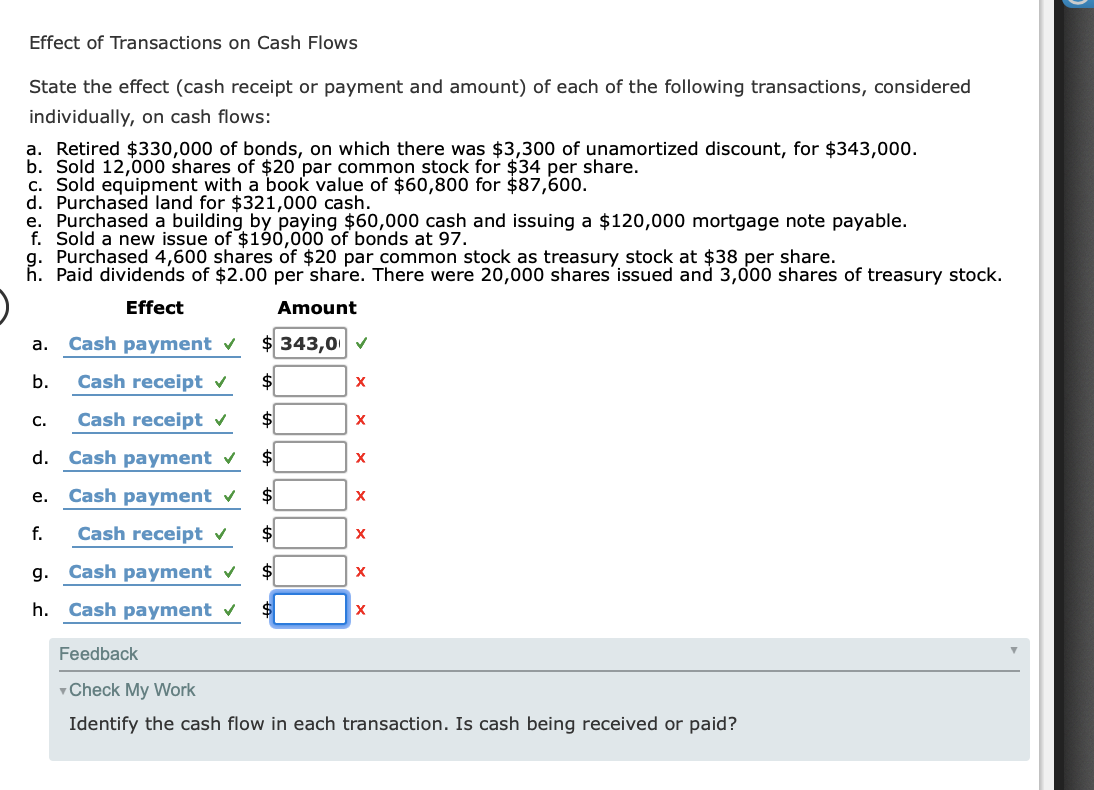

- Likewise, the company needs to make the journal entry for retiring treasury stock when it decides to not reissue the treasury stock back to the market.

- The journal entry for retiring treasury stock may be different from one company to another depending on whether the reacquisition cost of such stock is more or less than the amount the company received when the stock was originally issued.

Restrictions of Retained Earnings and Treasury Stock

Corporations may choose to hold treasury stock to raise capital later through resale, to boost shareholder interests, or to retire them completely. If you’re interested in finding a company’s treasury stock, look under the shareholders’ equity section of its balance sheet. when should you adjust your paycheck withholdings Treasury stock is a contra equity account recorded in the shareholders’ equity section of the balance sheet. Because treasury stock represents the number of shares repurchased from the open market, it reduces shareholders’ equity by the amount paid for the stock.

Great! The Financial Professional Will Get Back To You Soon.

Moreover, it signals a company’s confidence in its sound financial status, which improves investor sentiments. These shares do not pay dividends, have voting rights, or participate in future stock splits. The possession of treasury shares does not give the company the right to vote, to exercise preemptive rights as a shareholder, to receive cash dividends, or to receive assets on company liquidation. Treasury shares are essentially the same as unissued capital, which is not classified as an asset on the balance sheet, as an asset should have probable future economic benefits.

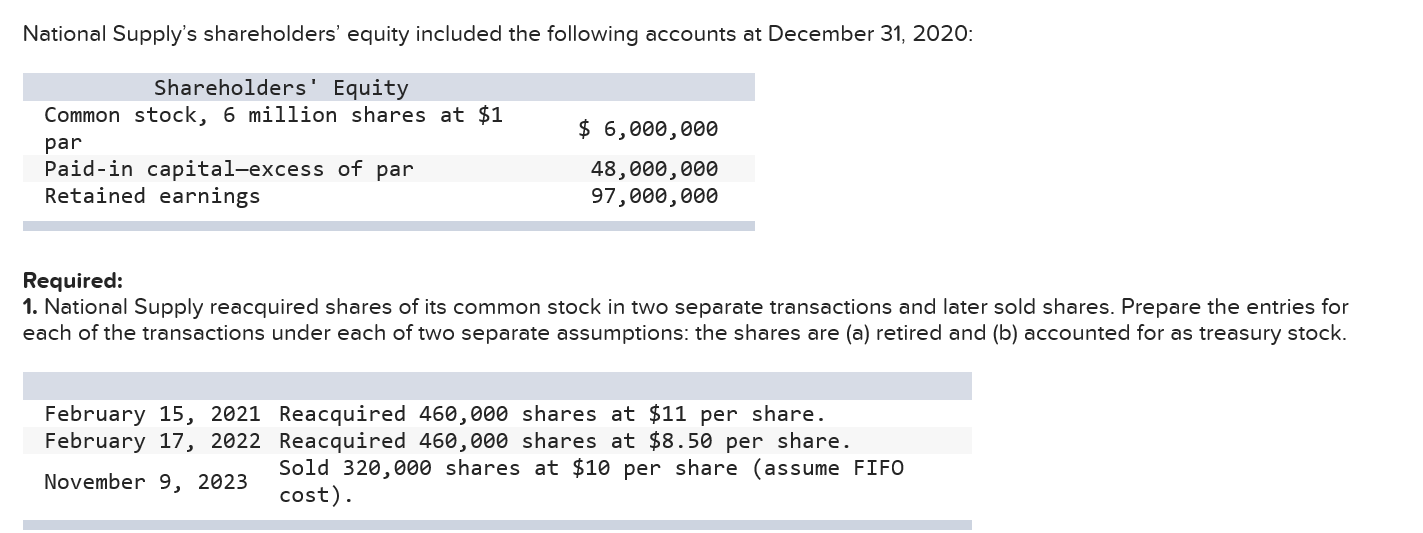

Example of the Constructive Retirement Method

Companies can pay for a stock buyback through cash on hand or through debt financing (borrowing money). Companies will either buy their shares on the market or purchase shares from existing shareholders. The stock’s earnings per share thus increases while the price-to-earnings ratio (P/E) decreases. A share repurchase can demonstrate to investors that the business has sufficient cash set aside for emergencies and a low probability of economic troubles.

The par value method is an alternative way to value the stock acquired in a buyback. Under this method, shares are valued according to their par value at the time of repurchase. This sum is debited from the treasury stock account, to decrease total shareholders’ equity. The common stock APIC account is also debited by the amount originally paid in excess of par value by the shareholders. The net amount is recorded as either a debit or a credit, depending on whether the company paid more or less than the shareholders did originally.

This arrangement permits the corporation to retire the shares and avoid future dividend payments. The debit to Retained Earnings reflects the position that the $8,000 was paid to satisfy stockholder claims that had arisen through operating activities subsequent to the issuance of the shares. The opposite would be true if the repurchase price is lower than the original issue price. Share buybacks can also be used as a defensive tactic against hostile takeovers.

As a shareholder you are not required to sell your shares back to the company in a share buyback; the company cannot make you do so; however, companies do offer a premium over the market price of the share to entice investors to sell. When the number of outstanding shares increases, this causes a dilution of per-share earnings. The resulting influx of cash is helpful in achieving the longer-term goals of a company or it can be used to pay off debt or finance expansion. Some shareholders’ shorter-term horizons may not view the event as a positive.

Shares repurchased by a company and held in its own account are referred to as “treasury stock.” This stock remains part of the company’s issued shares but lowers the number of outstanding shares. Another common way for accounting for treasury stock is the par value method. In the par value method, when the stock is purchased back from the market, the books will reflect the action as a retirement of the shares. However, when the treasury stock is resold back to the market the entry in the books will be the same as the cost method.

The company will also disclose the duration for which this offer is valid, and shareholders are welcome to tender their shares to the company should they be willing to sell at the specified price. Reducing the number of outstanding shares can serve a variety of important goals, from preventing unwanted corporate takeovers to providing alternate forms of employee compensation. For an active investor, it’s important to understand how the acquisition of treasury stock affects key financial figures and various line items on the balance sheet. The rationale for share repurchases is often that management has determined its share price is currently undervalued. Share repurchases – at least in theory – should also occur when management believes its company’s shares are underpriced by the market.