10 Sep Preferred Securities: What They Are and How They Work

In Goodrich Petroleum’s case, if dividends remain unpaid for six quarters, the preferred shareholders become entitled to two seats on the company’s board. One series also increases its dividend rate by 1% per year until all accumulated and unpaid dividends are paid in full. Preferred shareholders always receive dividends and asset payouts before holders of common shares.

Can You Calculate Earnings Per Share Without Knowing Preferred Dividends?

Miranda is completing her MBA and lives in Idaho, where she enjoys spending time with her son playing board games, travel and the outdoors. You may also consider the loss of or difference in dividend income that comes with switching to common stock. Also, if the issuer has additional optionality, they must pay the investors for it.

Interest Rate Risk

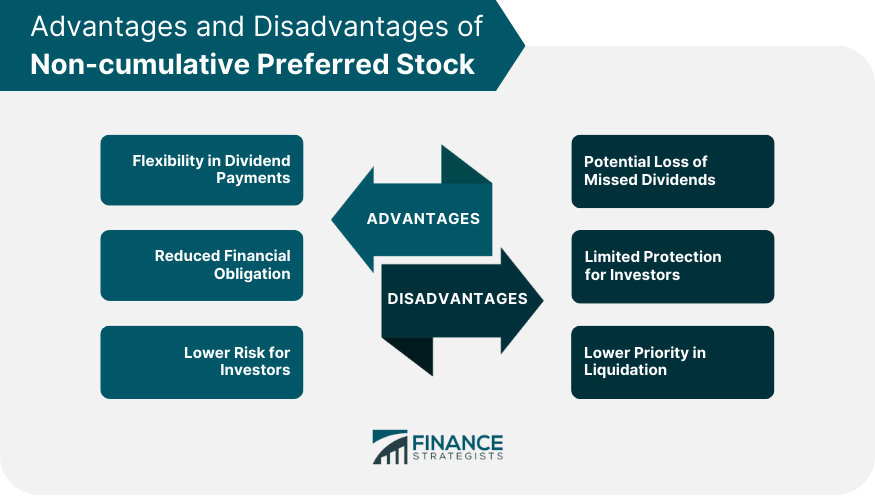

CPS typically does not provide voting rights to shareholders, while common stock provides voting rights to shareholders. This means that common stockholders have more say in the company’s management decisions than CPS holders. This makes it a less risky investment option than common stock, particularly in times of financial distress when the company’s ability to pay dividends and meet its obligations may be in question. CPS provides priority in dividend payments and liquidation preference over common stock.

What Are Preference Shares?

Cumulative Preferred Stock is a type of preferred stock that guarantees the payment of any missed dividends to shareholders. Callable shares are preferred shares that the issuing company can choose to buy back at a fixed price in the future. This stipulation benefits the issuing company more than the shareholder because it essentially enables the company to put a cap on the value of the stock.

Both in terms of its income potential as well as risk, preferred stock lies somewhere between common stock and bonds. Preferred stock promises the investor a fixed annual payment, usually expressed as a percentage of its face, also known as par value. No matter how profitable the issuing firm, the holder can never receive more than this fixed sum. Adjustable-rate shares specify certain factors that influence the dividend yield, and participating shares can pay additional dividends that are reckoned in terms of common stock dividends or the company’s profits. The decision to pay the dividend is at the discretion of a company’s board of directors.

Ask Any Financial Question

The Fund may invest in US dollar-denominated securities of foreign issuers traded in the United States. Investors interested in generating cash flow from their equity holdings may be better suited holding preferred equity or preferred stock. This type of equity investment represents ownership of a company and results in prioritized treatment for dividend distributions.

Once all cumulative shareholders receive the $1,500 due per share, the company may consider paying dividends to other classes of shareholders. Once the company resumes paying dividends, it must pay $1.125 per share to preferred shareholders before making any dividend payments to common shareholders. As with all investments, the answer depends on your risk tolerance and investment why use accounting software goals. Preferred stock works well for those who want higher yields than bonds and the potential for more dividends compared to common shares. Also like bonds, preferred stocks can pay a fixed dividend, but may also pay a floating rate that depends on some benchmark interest rate. Only after the interest on bonds are paid can holders of a company’s preferred stock be paid.

- The decision about whether to convert will depend on where the common stock is trading at the time of conversion.

- In exchange for lower volatility and higher income, preferred shareholders give up voting rights.

- While preferred stock and common stock are both equity instruments, they share important distinctions.

- Not every company offers convertible shares, but if the choice is available, you might be able to turn your preferred stock into common stock at a special rate called the conversation ratio.

Investors who are looking to generate income may choose to invest in this security. The most common sector that issues preferred stock is the financial sector, where preferred stock may be issued as a means to raise capital. In terms of similarities, both securities are often issued at face value or par value. This value is used to calculate future dividend payments and is unrelated to the market price of the security. Then, companies may issue dividends similar to how bonds issue coupon payments.